British Housing Market Stabilizing

12 Jun 2018

British Housing Market Stabilising

London housing prices had the biggest fall in April 2018 since 2009, while the UK average price was steady, and lenders say the prices are falling in wealthier regions, whereas the prices are still rising outside the capital. The nationwide rise was 5 per cent a year at the time of the Brexit vote, and this trend is expected to continue in 2018.

Halifax's reports show the house prices in London between January and March were on average £430,749, the lowest since 2015. But still, the shortage of homes is expected to aid the housing market.

Experts believe the prices show general consumer confidence, but it is still rising faster than wages, even when unemployment is reduced. As a result, it is tough to get affordable homes for eligible buyers.

Reports On Renting

-

Hamptons International Monthly Lettings Index show rents were up 1.9 per cent over April 2018.

-

ARLA Propertymark - April reports of the private rented sector indicate 26 per cent of tenants experienced a hike in rent. It is the highest since September 2017, when the landlords put rents 27 per cent up, and the year-on-year hike was 24 per cent in April 2017.

-

HomeLet Rental Index – UK rents 1.5 per cent up over April 2018.

-

The rent increase over the year to April 2018 was, on average, £918 per calendar month.

-

Rental growth has increased in East England by 14.67 per cent over the past five years, and the average rent paid for properties in England outside London stands at £769, with London, it stands at £1,234.

The managing director of Halifax, Russell Galley, said the growing strength of the labour market where the full-time employee in March grew by 202,000 is supporting housing prices. Buyers waiting for reasonable prices will act when the market meets their expectations.

Regional Variations Of Housing Prices In England

Regional variations of housing prices in England, excluding London, show a rise in prices. The highest price increase has been registered in North West, East Midlands and West Midlands.

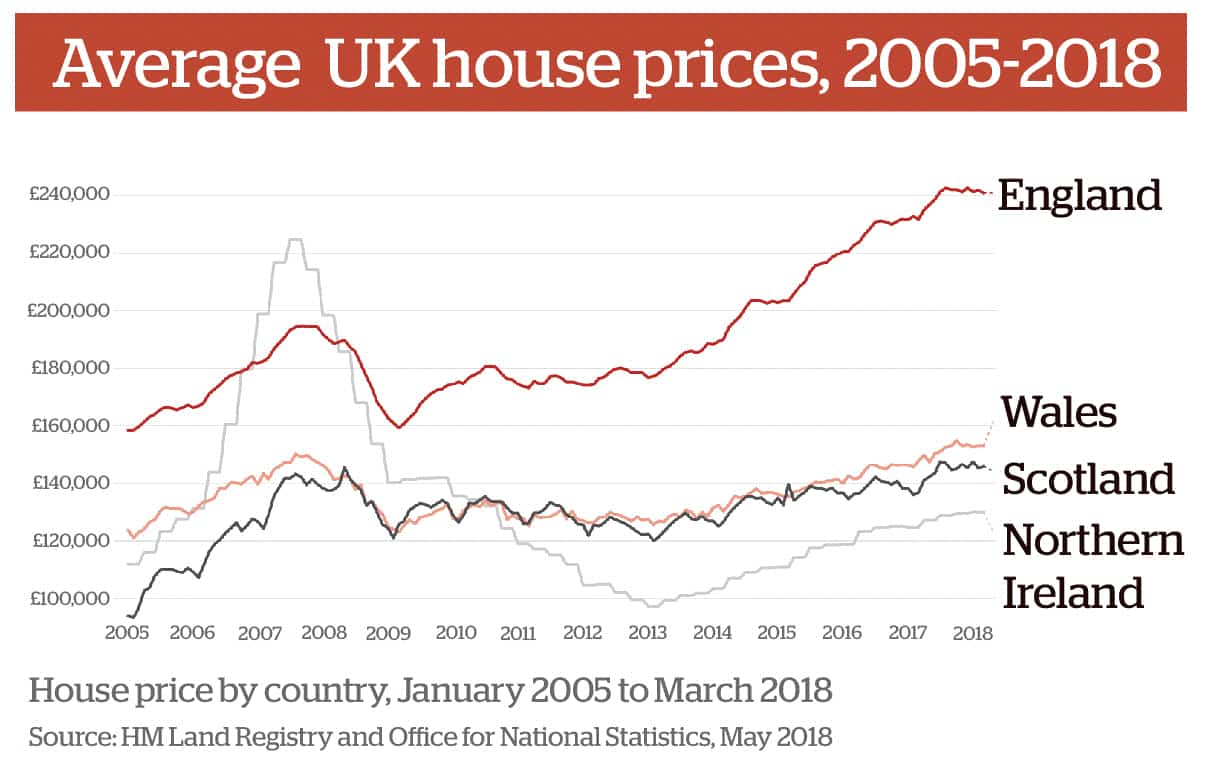

The East of England had the highest growth in 2017 -2018 when prices increased by 5.8 per cent. The Official figures released by ONS in partnership with the Land Registry show the average home price in the UK in March 2018 was £224,144, which was less by approx. £500 as compared to February and £9,000 more than March 2017.

In comparison, Liverpool's average price increased by 12.5 per cent from March 2017 to 2018. Liverpool had the strongest gains in the property market, and the reason for the rise in the North compared to the South is the availability of affordable homes in the North compared to the South. Compared to London, Liverpool is one of the strongest markets in the UK now.

Housing Price Trends Move Upwards

The latest house price index by Halifax shows rates grew 1.5 per cent in May, in contrast to the decline of 3.1 per cent seen in April 2018.

Prices have dropped in the past months, attracting new buyers.

Housing Price Trends Move Upwards

The latest house price index by Halifax show house prices grew 1.5 percent in May in contrast to a decline of 3.1 percent seen in April 2018.

Prices have fallen in the past months and this attracted new buyers.

Average UK house prices from 2005 to 2018.

Categorised in: All News